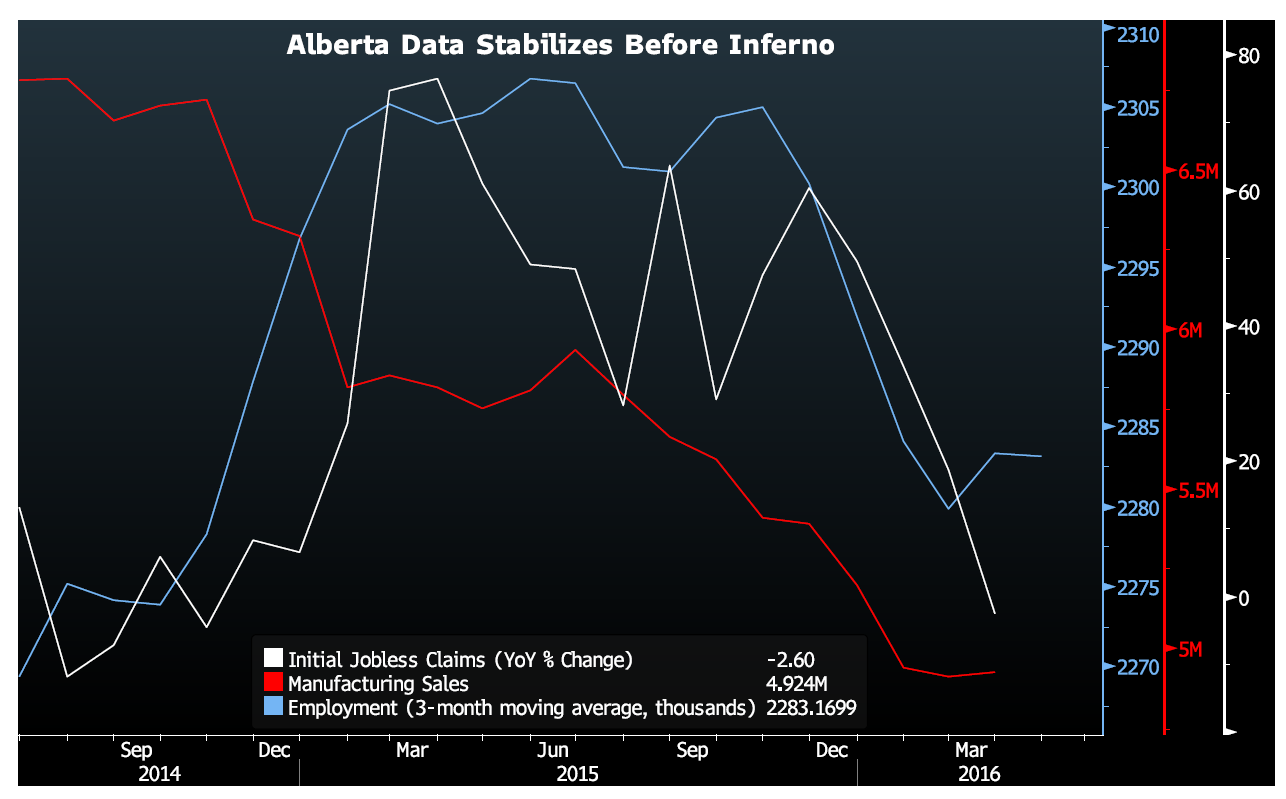

In 2015, as oil was in a free fall from the days of $100+ a barrel, Alberta’s economy had little to be optimistic about—but around January 2016, something changed. There was cause for optimism, and an air of stability was hitting the province.

As you can see, Initial Jobless Claims (unemployment) plummeted, manufacturing sales started to level off, and the 3 month employment average was coming back. Statistics Canada reported that initial jobless claims for the province declined on an annual basis in March, the first such drop since October 2014, when the Alberta recession started.

A lot of this could be due to the rallying of oil, as it starts to pick back up. You can see from the chart that the recovery and stabilization almost perfectly coincides with the oil rally:

But then we move to May, and the Fort McMurray fires. There’s no doubt that the the Alberta economy will be adversely affected now, and for months into the future, by the inferno. “The fires will create major distortions in the economic data over the second quarter, if not longer,” wrote Manulife Asset Management Senior Economist Frances Donald. “These data distortions will make it difficult to confirm conclusively whether the first quarter stabilization was indeed an improvement or only a temporarily pause in a longer-run economic decline.”

However, with signs of a economic stabilization prior to the fire, is there any room for optimism after the fire? Well, let’s look:

Real Estate

“There’s no better example of the underlying firmness in the Canadian housing market than recent signs of stabilization in hard-hit Alberta, and in particular Calgary,” added Bank of Montreal Senior Economist Sal Guatieri. “After plunging almost 30 percent last year, existing home sales in the city are now sliding at a slower 10 percent year-over-year rate, while the decline in benchmark prices has steadied at 3.5 percent in the past three months.”

Oil Prices

Oil recently rallied to above $50, its highest level since November 2015. Some of this is certainly due to the wildfires in Fort McMurray, but there’s more causes than that, that should leave us optimistic about its continued rise.

Demand has been much higher than expected in the last few months, in key economic areas like China, Russia, and India. Disruptions in supply, besides Fort McMurray, like in Venezuela and Nigeria, have dramatically reduced the stock of available oil.

Michael Hewson, chief market analyst at CMC Markets said, “while supplies remain elevated, the glut does now appear to be diminishing.”

Supply outages and growing demand from China mean crude prices will come into “much better balance” in the next few months, an energy analyst told CNBC.

Construction

What people often don’t realize is that construction, not oil, is the king of Alberta’s economy. Construction is the largest industry in Alberta, followed by healthcare, retail, professional science services, then oil.

And there’s a lot of money currently being pumped into infrastructure spending and construction: “Alberta’s NDP government intends to spend nearly $8.5 billion this year to build and modernize key public infrastructure in hopes of jump-starting the province’s slumping economy.”

One good measure is the value of building permits, which recently jumped 15.5%, 47.7% on higher construction intentions, and 114%, a record high.

So, is there reason for optimism? We hope so!